Store and Company Default Sales Tax Values

For sales tax to be triggered in the LS POS, each sales line has to have an Item sales tax group and a Sales tax group.

For each sales line:

- The Item sales tax group takes the value from the item.

- The sales tax group takes the value from the store or customer

Normal cash sales in LS POS do not involve customers so they use the store’s value but when a customer is entered into the sale the customer value overwrites the store value.

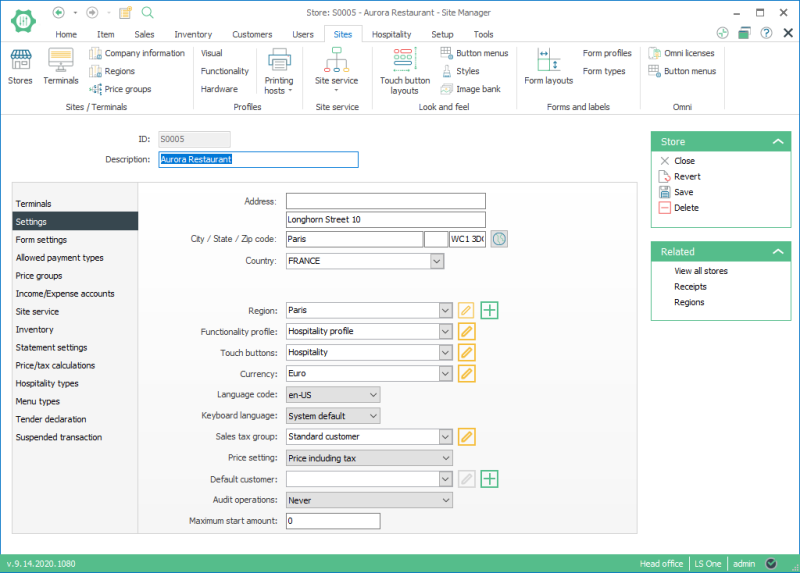

To configure a Sales tax group for a store:

- Select Sites > Stores;

- Select the store and open it;

- Select tab Settings;

- In the field, Sales tax group, select the store’s default tax value.

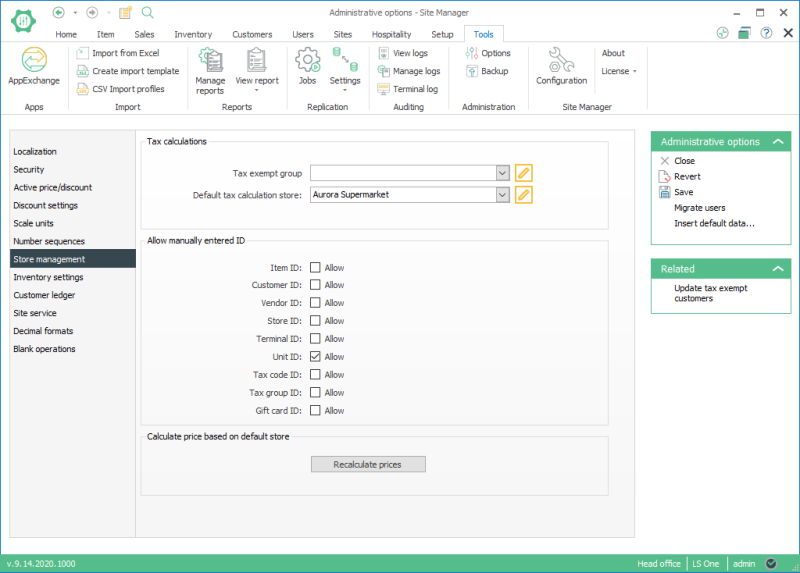

For the company, one more set up for the Site Manager needs to be done and that is to define which store has the setup for the sales tax group. The retail item card looks for this store and its value to select which sales tax group to use to calculate the tax for the price including tax.

To define which store is the default tax calculation store:

On the Ribbon select tab Tools > Options, Select the tab Store management.

In Tax calculations, select the store that is the default tax calculation store for the Site Manager.

| Last updated: | 16th February 2017 |

| Version: | LS One 2017.1 |